Why Kroger Is A Great Dividend Stock To Own

An Overlooked Dividend Compounder

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Current Price: $67.10

Portfolio Purpose: Income 💰 & Growth 📉

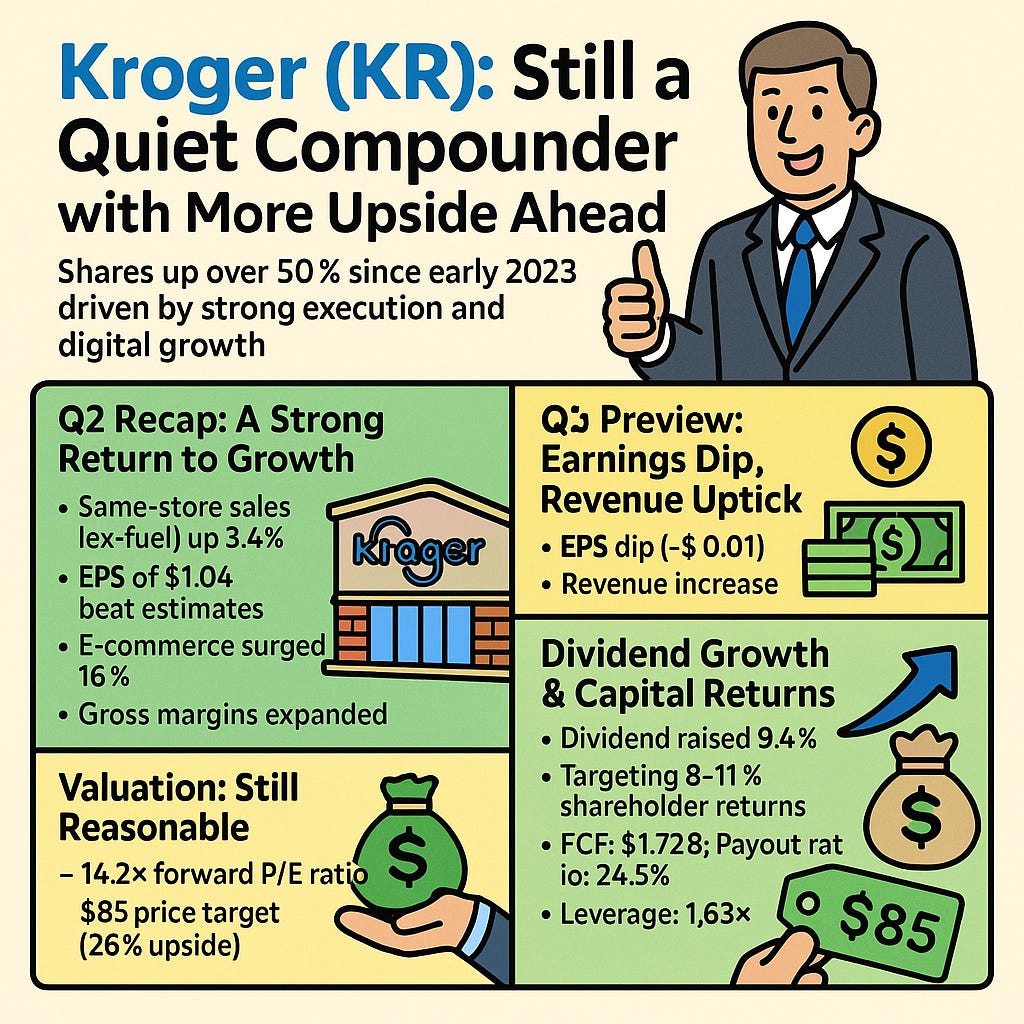

Amid economic uncertainty, few retailers have shown Kroger’s (KR) consistency. Shares are up over 50% since early 2023—slightly ahead of the S&P 500. This has been driven by strong execution, disciplined cost control, and a renewed focus on store brands and digital growth.

Q2 Recap: A Strong Return to Growth ↗️

Kroger’s most recent quarter delivered a notable turnaround from its softer 2022 & 2023.

Same-store sales (except fuel) grew 3.4%; far better than Albertsons’ (ACI) 2.2%.

EPS of $1.04 beat estimates & rose 5% YoY.

E-commerce surged 16%, surpassing last year’s 10%.

Gross margins expanded 40 basis points to 22.5%.

The grocer also closed 60 unprofitable stores and reaffirmed digital investments as a major growth priority heading into 2026.

Q3 Preview: Earnings Dip, Revenue Uptick 💵

Analysts expect:

A slight EPS dip (-$0.01)

A modest revenue increase

This cautious outlook is driven by a $2.6B impairment charge, which will temporarily weigh on the bottom line. I expect Q3 EPS between $1.02–$1.06, supported by store-brand strength and buyback-driven EPS leverage.

Guidance Raised—Again 👍🏾

Management lifted full-year guidance across:

Sales

Operating profit

EPS

Identical sales for 2024 came in at 1.5%, margins continue to expand, and Kroger expects sharper improvement if interest rates ease in 2025.

Dividend Growth & Capital Returns 💰

Kroger raised its dividend 9.4% in June. Its 19th consecutive increase. And they continue to target 8–11% annual shareholder returns.

Other financial highlights:

Shares outstanding fell from 722M → 661M

Cash from operations climbed to $3.69B

Free cash flow: $1.72B

Dividend payout ratio: 24.5% (very safe)

Leverage: 1.63x, below peers CASY (1.8x) and ACI (2.2x)

KR has $7.5B in buybacks on pace to be exhausted, with an additional $2.5B planned to follow.

Valuation: Still Reasonable 🆗

At ~$67 per share and midpoint guidance, Kroger trades at a forward P/E of ~14.2x. This is far cheaper than peers:

Casey’s (CASY): ~30x

Walmart (WMT): ~40x

Applying a modest 15x multiple yields a $85 price target (26% upside).

A re-rating toward 18–20x is possible if e-commerce and private-label momentum persists.

Partnerships with Uber Technologies (UBER), DoorDash (DASH), and Instacart (CART) and other potential acquisitions could further expand market share.

Risks ⚠️

Sales remain slightly down YTD

Rising unemployment could pressure 2026 demand

Recession risk may compress margins

Competition from Walmart, Casey’s, and Albertsons remains intense

But I still believe that Kroger’s cost reductions, store closures, and strong brands keep them positioned better than most food retailers.

Bottom Line ✅

Kroger remains a resilient, highly cash-generative business with:

Expanding margins

Consistent share buybacks

Under-appreciated e-commerce growth

A long runway in private-label products

Very reasonable valuation

Despite macro uncertainty, I continue think Kroger is a good by for those looking for income and solid long-term upside.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. I am not a licensed professional. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.