Why Owning Dividends Are More Attractive Than Buying Real Estate

"Use Covered Call ETFs To Generate Passive Income"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t need to need to work to traditional retirement age. I want to help you take control of your life by achieving F.I.R.E.

After retiring from the military I focused on building my business on Seeking Alpha, and now Substack. As mainly an income investor I’ve always loved the idea of owning stocks vs real estate. And in 2025, generating passive income has never been easier with the growing popularity of high income, covered call ETFs.

Everyone in the military always talked about owning real estate, but never the headaches that came along with it. Buying a house is easy. Ever wondered why a bank would approve a young person for a home loan but is less likely to do so for a business loan?

While owning a home can be lucrative, dealing with tenants and toilets is never something that interested me. The maintenance, upkeep, and costs associated with a home can be overbearing.

Let’s be honest. Many prefer to own homes due to the tangibility. You can brag to your coworkers or friends about someone paying your mortgage for you. But honestly, how much cash flow are you generating from that one home?

Unless you paid for it in cash, how much are you making at the end of each month? Probably a few hundreds dollars? And no one ever talks about that tenant that hasn’t been paying rent. When you think of it like that, is it really worth it?

I’m not saying I’m against owning a home, but the costs can add up. And if you’re not prepared, your physical asset can seem like a liability.

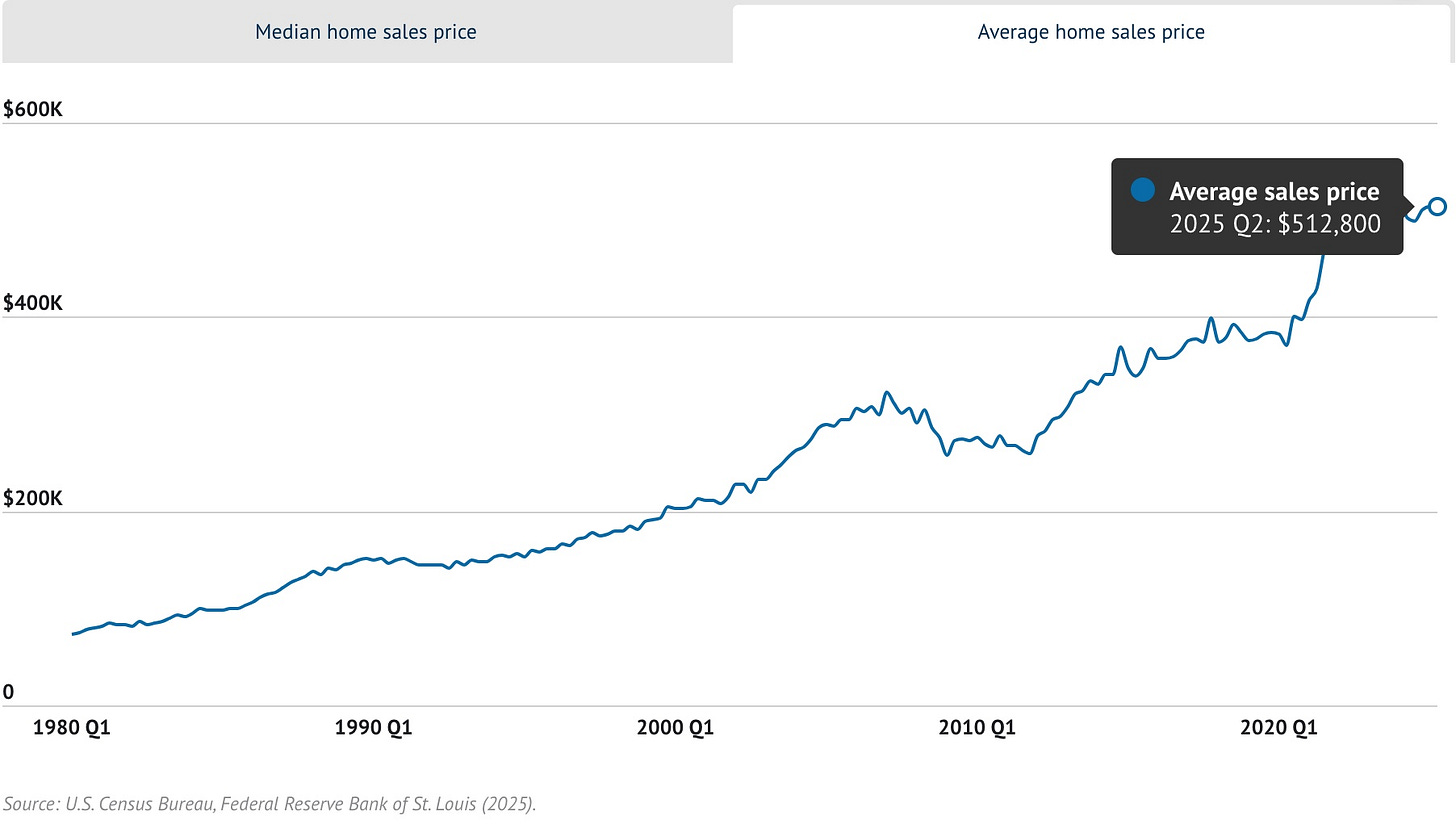

Below is the cost to own a home in the U.S. from 1980 until now. In Q2’25, the average cost of a home was $512,800. Of course, in certain states this varies by location.

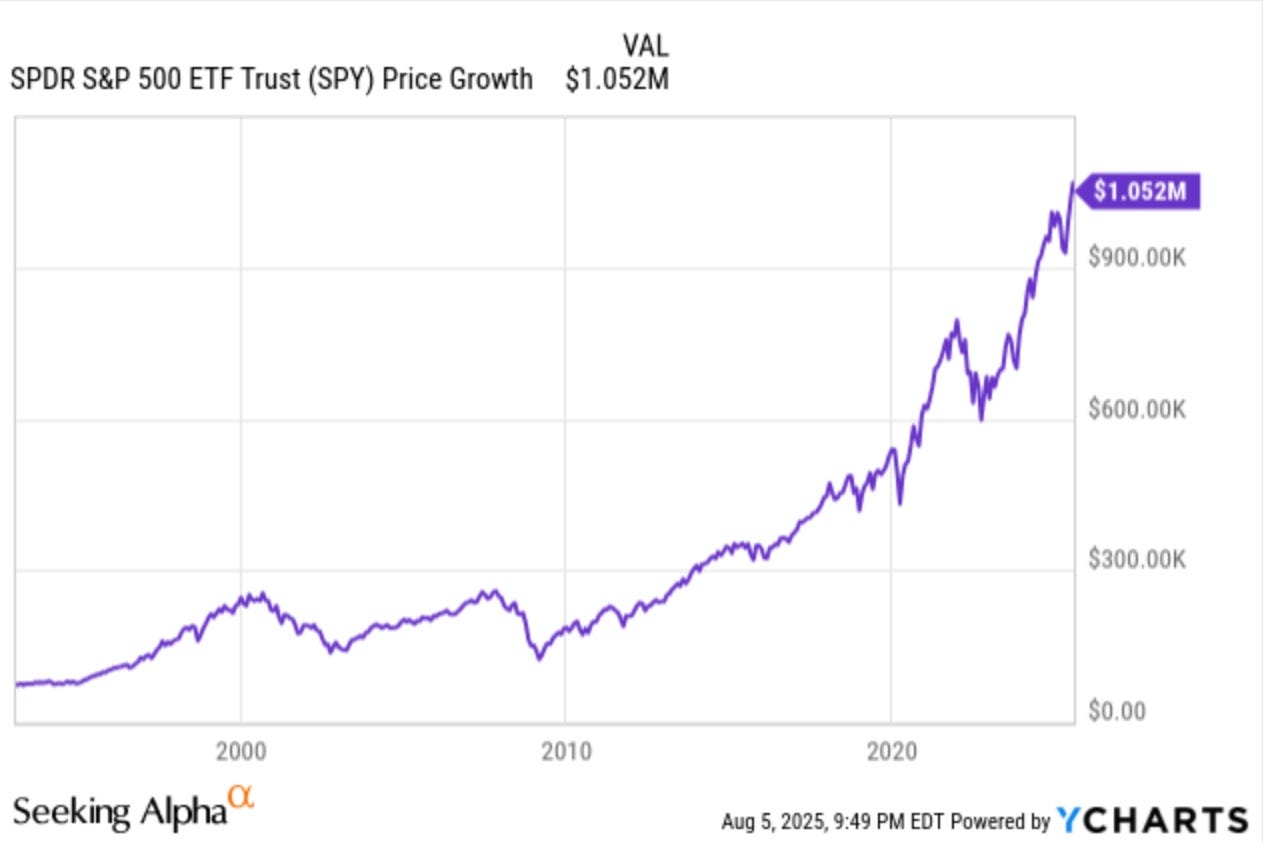

Some may point to the chart and say you would have had a significant return on your investment if you bought a home back in 1980 and sold years later. And while this is true, the stock market goes up over time as well.

In 1980, the average price to buy a home was $73,600. Even if you held that money and invested it 13 years later into the first S&P 500 ETF (SPY), it would be worth over $1 million today, not including dividends.

So, when people mention how home prices always increase over time, I say so does the stock market, but without the costs of ownership. Hypothetically speaking, imagine if you had $512,800 you wanted to invest.

Most would likely tell you to invest it into physical real estate, repeating what they’ve heard for years. Again, I’m not knocking real estate as I plan to venture into it myself in the not too distant future. But here’s why I prefer to invest for dividends instead.

Below I chose three covered call ETFs as an example. I included their closing prices, distribution yields, and average distributions for 2025 so far:

SPYI - NEOS S&P 500 High Income ETF/ Price $50.69 / Yield 12.09% / $0.5030

QQQI- NEOS NASDAQ-100 High Income ETF/ $52.33 / Yield 13.96% / $0.6082

BTCI- NEOS Bitcoin High Income ETF/ $61.45 / Yield 22.57% / $1.66

Dividing the average home price comes to $170,933 allocated to each. Using each fund’s average distribution, below is how many shares you would get and the monthly income you would generate:

SPYI = 3,372 shares total for a monthly payout of $1,696.

QQQI = 3,266 shares total for a monthly payout of $1,992.

BTCI = 2,781 shares total for a monthly payout of $4,616.

Grand total = $8,304.

So, you as the investor would generate over $8,300 a month in passive income. No tenants to deal with, no broken toilets, no property taxes, nor maintenance costs. And while dividends and/or distributions aren’t guaranteed, buying high quality stocks or ETFs can help generate a substantial, reliable source of passive income.

Like & subscribe if you’re active duty, a veteran, or just love investing.

A compelling case for dividend-focused investing as an alternative to real estate. Clear math, strong yields, and zero landlord headaches make this worth considering for passive income seekers.

Thanks so much for the article… I’m new to stocks and dividends. My questions are… how do investors afford to buy so many shares of each of these stocks?? Are they using margin? Also, what are the taxes applied to this income when you withdraw? Are there any tax advantages? I would really appreciate your feedback.