Why Pay More For The Same Results?

"Buy This Low Cost S&P 500 ETF"

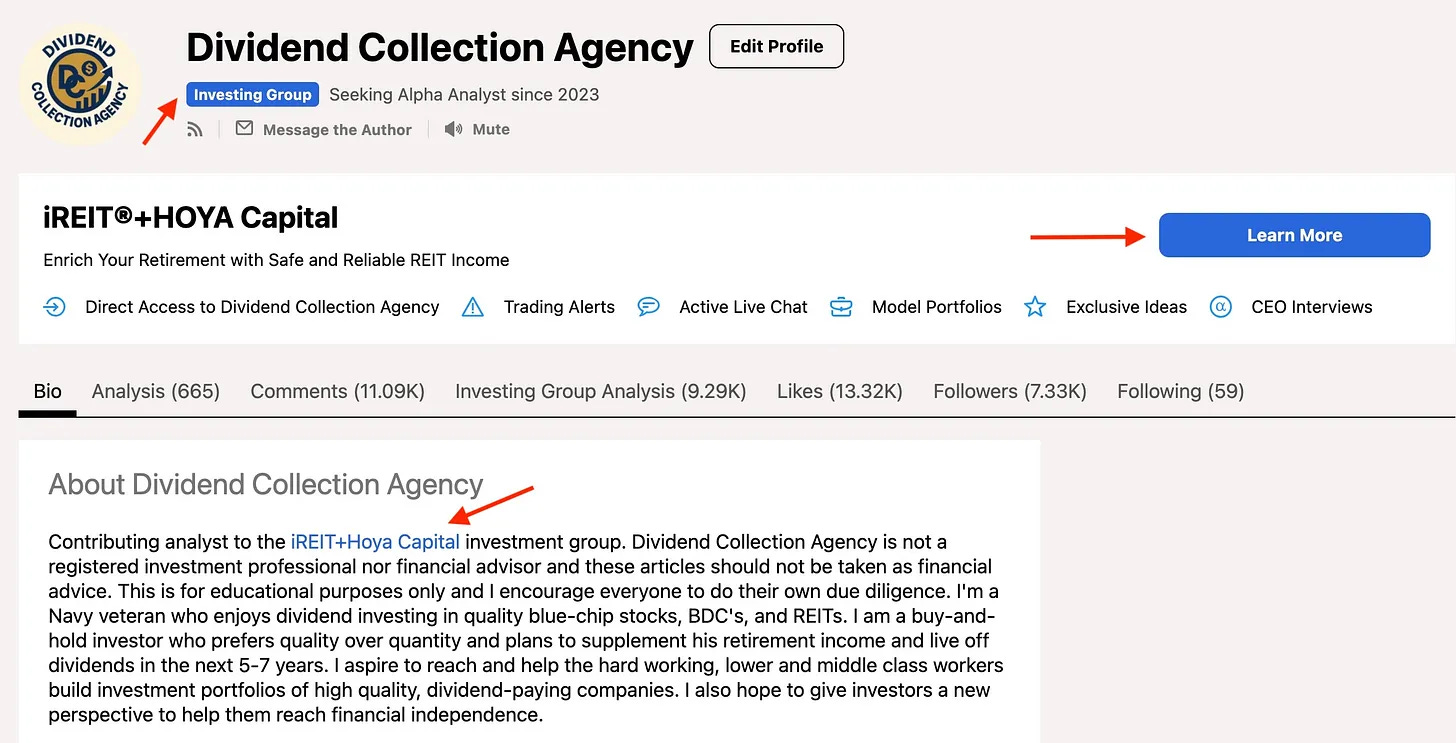

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Above is a 10-year total return comparison chart of four major ETFs that track the S&P 500:

✅ State Street SPDR Portfolio ETF (SPYM)

✅ Vanguard S&P 500 ETF (VOO)

✅ State Street SPDR S&P 500 ETF (SPY)

✅ iShares Core S&P. 500 ETF (IVV)

For those that don’t know, total returns are just price returns including dividends reinvested.

Over the past 10 years, all four have had near identical returns.

VOO leads the pack by less than 1%.

All four ETFs hold the same exact stocks & were created to do the same job…track the S&P.

Their slight differences in returns has to mainly do with their expense ratios and dividend reinvestment timing.

SPYM has the lowest expense ratio at 0.02%, while SPY has the highest at 0.09%. IVV and VOO’s are identical at 0.03%.

And SPYM’s price is significantly cheaper at $78.94!

Especially, when compared to:

✅ IVV: $643.09

✅ SPY: $670.98

✅ VOO: $617.00

So, why not buy SPYM for a significantly cheaper price if it does the same exact job as the other 3 with similar results?

Why is it that so many financial pages on social media tell you to buy VOO with no reasoning behind it besides the fact that it’s more popular?

Popular stocks don’t growth your wealth, strategy does!

Moral of the story?

Stop blindly following these alleged “financial gurus” who tell you to buy stocks with no reason why.

This is the fastest way to lose out on wealth building opportunities.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.