Why Stock Price Doesn't Always Tell The Story

Price Is What You Pay Value Is What You Get

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

Today a favorite REIT in my portfolio, VICI Properties (VICI), reported their Q2 earnings. If you’re not familiar with VICI, they’re known for their iconic properties on the Las Vegas Strip like Caesar’s Palace, The Venetian, and The MGM Grand to name a few.

They also own casinos in Canada, golf courses (Cabot Golf), health & wellness resorts (Canyon Ranch), Chelsea Piers in New York, and hotels in Biloxi, Mississippi. I’ve also gotten to know their CEO, Ed Pitoniak, professionally, which has allowed me understand his thought process firsthand. This has also reinforced my understanding of the business and why I plan to continue being a shareholder.

But over the past 4 years VICI’s share price has been stagnant. In the chart below you can see at the end of July in 2021, the share price was $31.47. They currently trade at $32.53, roughly $1 higher.

Warren Buffett has stated, “Price is what you pay, value is what you get”, meaning that the stock price is not always reflective of its value. Buffett has also stated he loves when the prices of the things he buys go down as this means he can get more for his money. And I believe at VICI’s current price you are getting great value.

And that’s because you need to know why a company’s share price may be stagnant. REITs are highly sensitive to interest rates. When interest rates are higher, REITs typically underperform and vice versa.

I wanted to bring this to your attention because so many investors get caught up in the stock price. If they see a stock’s share price skyrocketing, they assume it’s a great stock to buy. And if a stock’s share price is stuck, or volatile, they assume it’s not a quality stock.

But the financial metrics of a company are what you should be paying attention to: How has the company grown since their price has been volatile / stagnate?

In the shorter term share prices follow headlines, but in the long term share prices follow the fundamentals.

So, if you’re reading this, pay close attention. In the previous chart you see VICI’s share price has been relatively flat the past four years.

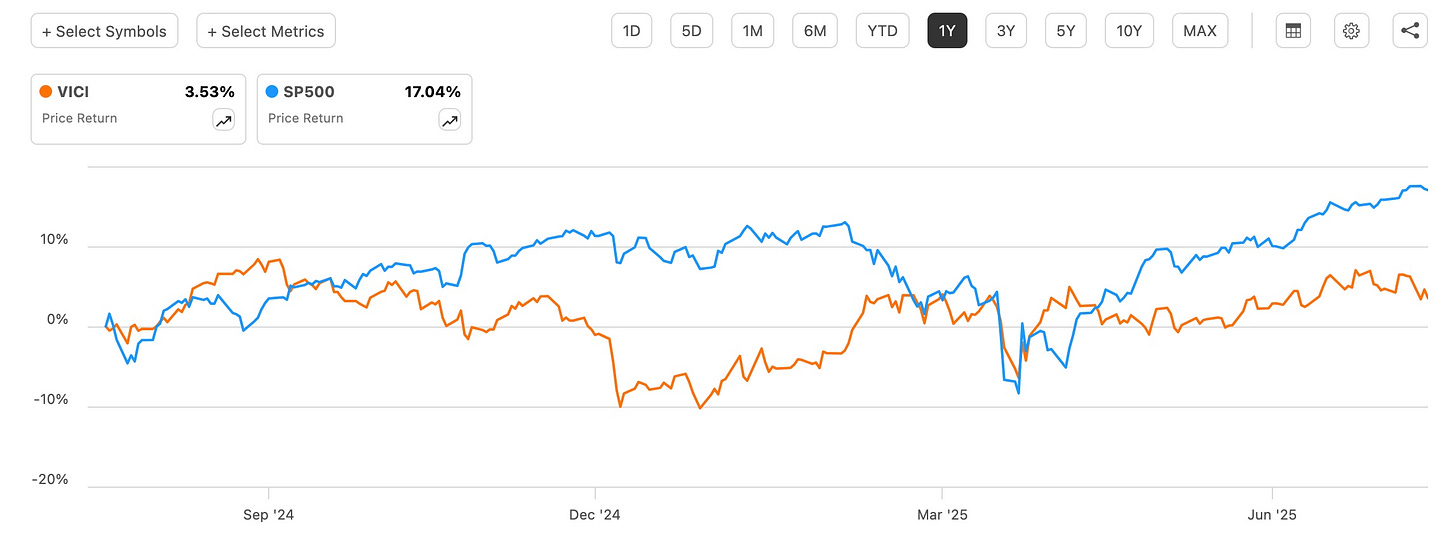

And in the chart below you can see the share price has significantly underperformed the S&P, up only 3.5% to 17% for the index.

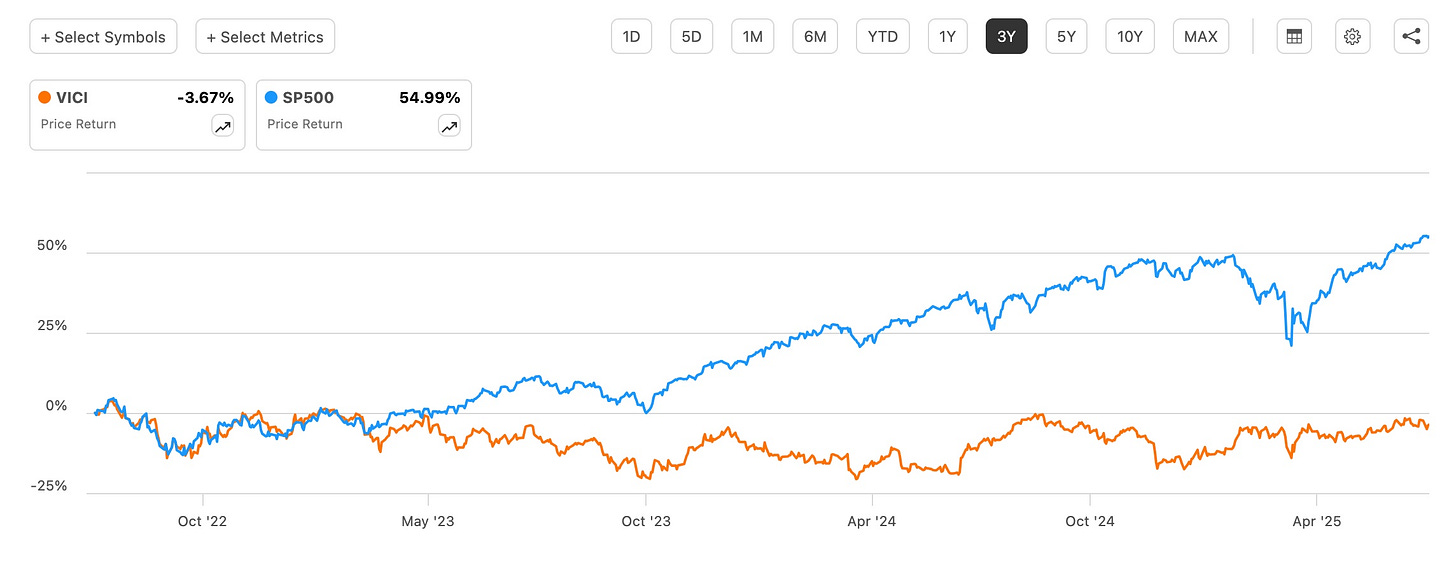

In this chart, VICI’s share price is down in the past 3 years while the S&P is up roughly 55%.

But because VICI Properties is a REIT, they should be viewed as income, or total return vehicles. Meaning investors should focus on total returns instead of price returns. The difference is total returns include dividends.

Below you can see over a 5-year period VICI has outperformed the S&P in total returns, up 97.43% compared to 96%.

But here’s where it gets better. In that four year period, VICI has grown their earnings by nearly 3x.

Here’s their growth from 2021 until today:

Revenue: $376.4 million - $1 billion. Growth rate = 165.7%

Adjusted funds from operations (AFFO): $0.46 or $256.1 million - $0.60 or $630.2 million. Growth rate = 146%

Dividend: $0.33 - $0.4325. Growth rate = 31%.

So, you can see both revenue and AFFO more than doubled in the past four years. And while this is not the high growth some stocks in the technology sector see, this is solid growth for a REIT.

Additionally, VICI is slated to raise their dividend again soon, likely to $0.45 a share, representing a growth rate of 36.4% in the past four years.

As long as a company is growing and doing the job you bought them for, then the share price shouldn’t matter as much. And if it drops, you should take the opportunity to buy more if you’re a long-term investor.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Impressive growth rates! Thanks for writing this!