Why You Should Be Investing In REITs

Create an income stream without the headache of owning physical properties

I often tell my friends about investing in real estate through the stock market, or REITs. Many are unfamiliar with REITs, while others prefer the idea of owning physical real estate. While owning physical real estate has its advantages, I get the idea that many people just like the fact that they can brag about owning a physical properties.

To say, “I own that property and a tenant is paying my rent.” And while this is great, no one ever talks about the drawbacks of owning physical real estate. Tenants refusing to pay rent, roof replacements costing thousands of $$$, increased HOA fees, or high mortgage rates. It always seems to be one thing after another.

Sure, you can refinance your loan at a lower rate once interest rates decline, but no one ever mentions the fact that the terms of the loan start over. Or that you’ve already paid a high interest rate for a few years.

Or that your costs like insurance, property taxes, or maintenance are likely to increase over time due to high inflation. Additionally, many go hundreds of thousands of dollars in debt just for a few hundred bucks of cash flow.

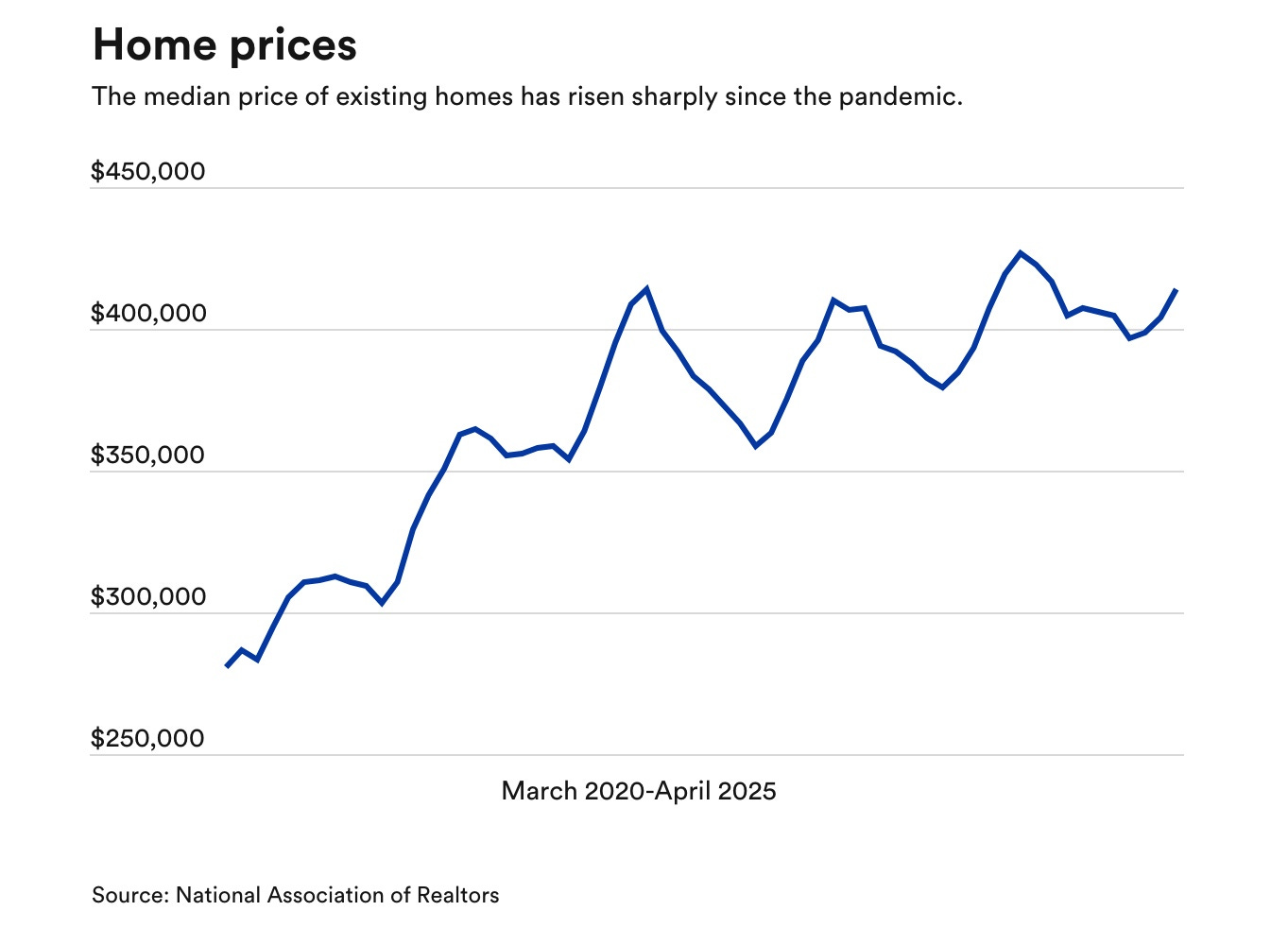

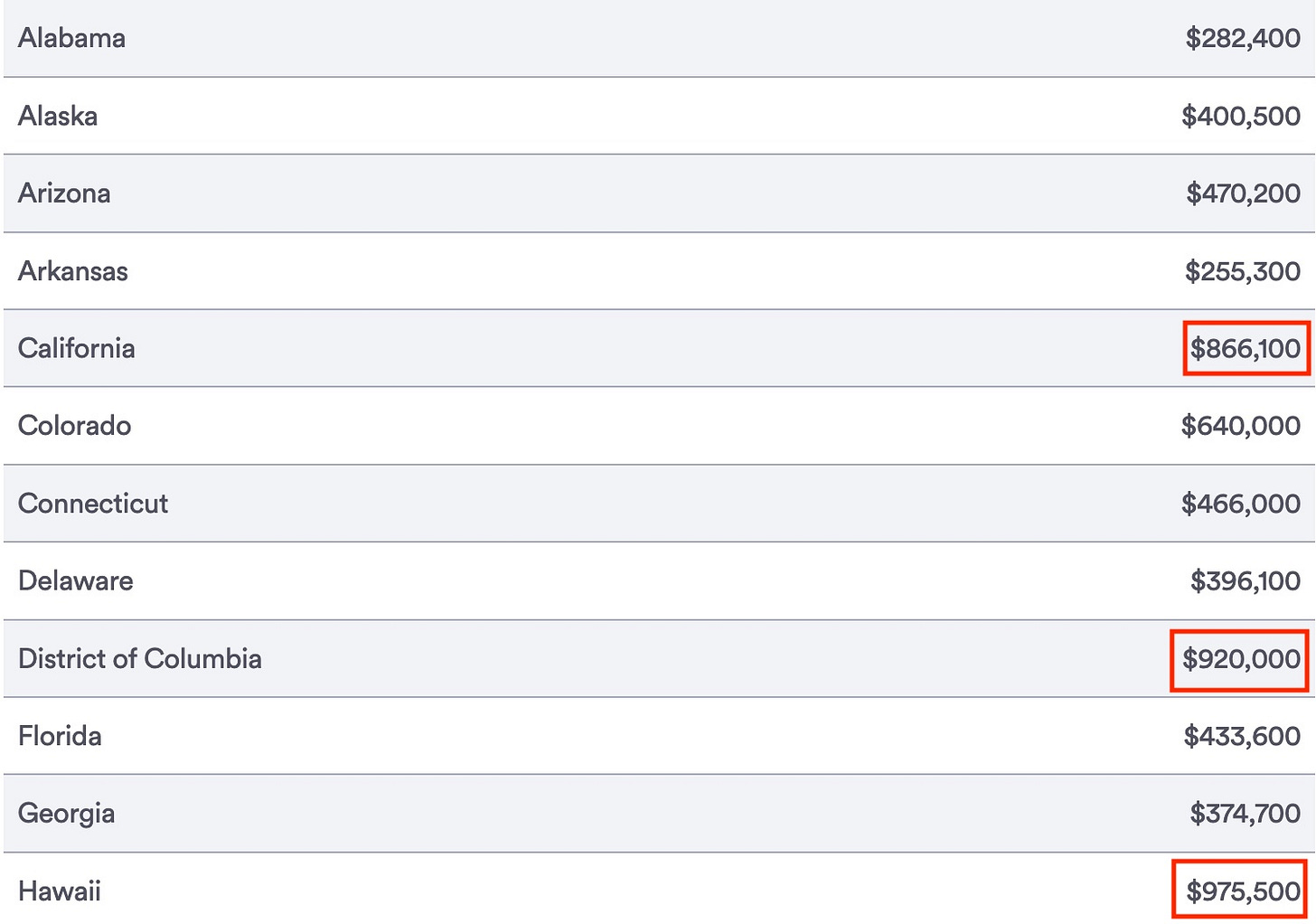

Below is the average home price in America as of April 2025, roughly $425,000.

To no surprise, Hawaii, California, and Washington, D.C. are the top 3 states with the highest home prices. Iowa, Oklahoma, and Ohio are the top 3 states with the most affordable home prices.

It surprises me that many people are unfamiliar with REITs.

REITs were created by Congress in 1960 after being signed into legislation by President Eisenhower. And these were literally created to give small investors access to income-producing real estate.

My friend who recently sold his house said he was collecting around $575 a month in cash flow. But after his HOA fees increased because of inflation, this cut into his cash flow by $105, netting him $470 a month.

Using the 3 REITs in the chart above, Agree Realty, VICI Properties, & Realty Income, here’s how much you’d collect in monthly income if you invested the average home price amount of $425,000 into these three companies at their current prices:

Realty Income: $57.26/share = 7,420 shares. Using their dividend of $0.269 a share, this would give you $1,996 a month.

VICI Properties: $32.27/share = 13,170 shares. Using their dividend of $0.4325 a share, this would give you $5,696 a quarter, or $1,898 a month.

Agree Realty: $74.64/share = 5,700 shares. Using their dividend of $0.256 a share, this would give you $1,459 a month.

I used these three REITs as examples because of their strong fundamentals and because of the quality real estate they own. Agree Realty & Realty Income own retail properties leased to well-known companies like Walmart, Dollar General, & Home Depot to name a few.

VICI Properties owns iconic assets primarily on the Las Vegas Strip like Caesar’s Palace, MGM Grand, & Mandalay Bay. And their properties paid 100% of their rent during COVID. So, it’s safe to say they’ll be around for a long time.

Yes, physical real estate typically appreciates over time, but so does does stocks. Especially if you buy high-quality ones at the right price. Furthermore, like the stock market, the housing market also experiences corrections and crashes.

So, the moral of the story is while physical real estate is one way to build wealth, owning REITs could also grow your wealth while giving you a reliable stream of income without the headache of tenants, rising costs, or taxes. They’re also very liquid as you can sell your position with the push of a button if you have an emergency and need cash right away.

Or even better, you can borrow against your assets, similarly to a HELOC, or Home Equity Line of Credit against your home. This is called a SBLOC, Securities-Backed Line of Credit.

If you like receiving passive income, then you should also consider investing in REITs.

Like & subscribe if you’re active duty, a veteran, or just love investing.