Why You Should Invest In Quality Stocks Long Term

"Quality Over Quantity"

Everything I do in life I take a quality over quantity approach, and when it comes to investing, the same rule applies. Currently, I only invest in what I view as high-quality, dividend paying stocks that will likely pay me during good and bad times.

While any stock could face financial distress, quality companies are likely to go up over time. A stock’s price usually follows their earnings growth. High growth stocks usually trade at higher valuations, while low growth stocks usually are cheaper.

Some examples include: Visa (V), a high growth stock that typically sees double-digit earnings growth. A low growth stock that usually sees low, single-digit growth is Verizon (VZ). Both are quality stocks in my opinion.

And both deserve a spot inside an investor’s portfolio, depending on your goals. They also meet my requirement of paying dividends. If you’re looking for income at a reasonable price, Verizon is your best bet. But don’t expect much growth. In 5 years, their stock price will likely be relatively similar to where it is now because of their low growth.

Visa on the other hand is likely to have a much higher share price as a result of their high growth.

And while this is not guaranteed, one thing I can all but guarantee is both will experience price corrections or even crashes. Whether this be from company-specific issues or overall market weakness from outside factors like a recession, or geopolitical turmoil.

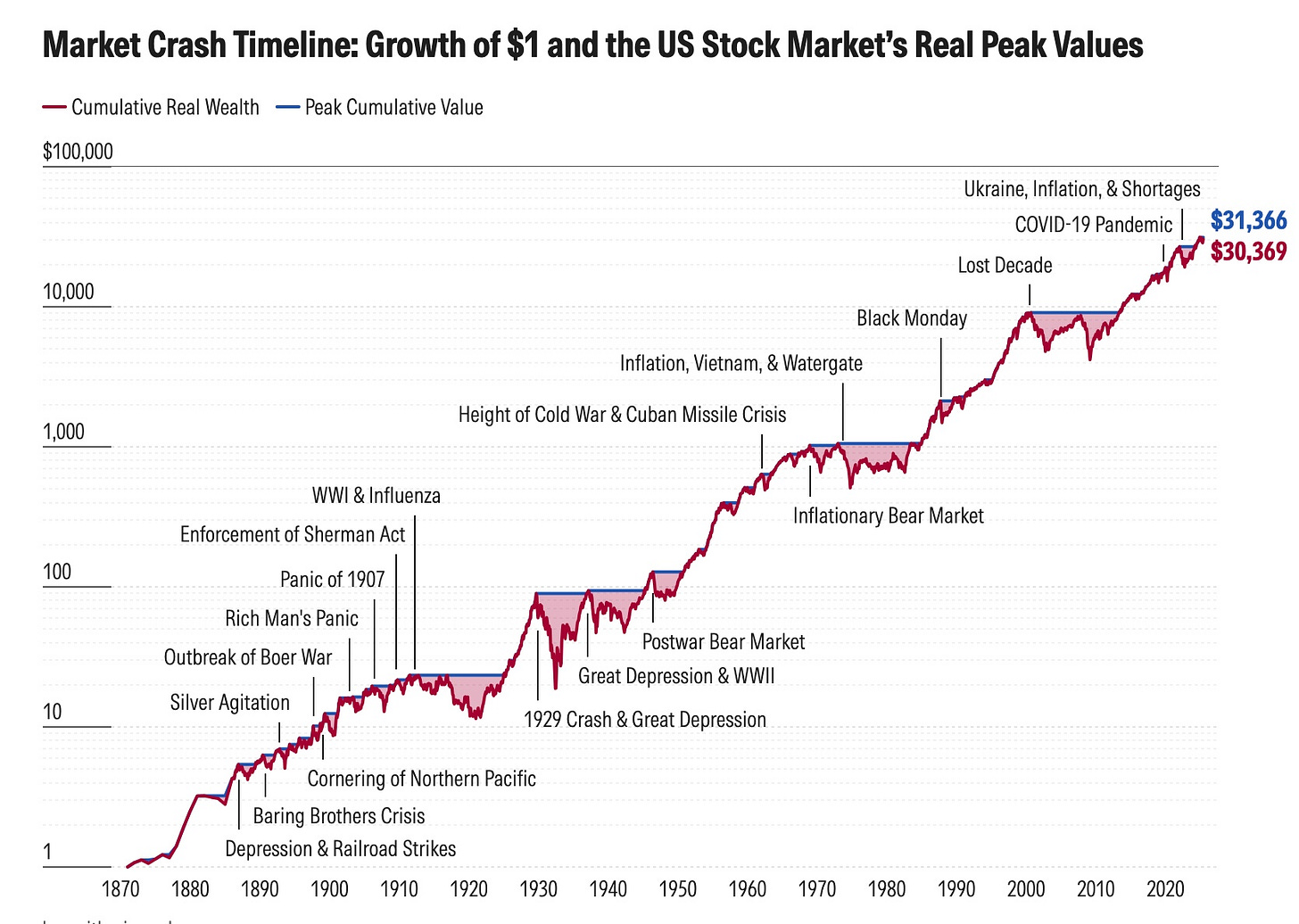

That’s just the nature of the beast. Below is a chart of the overall market trend over the last 150 years. As you can see, the market has continued to go up over time.

Over that time years we’ve seen the crash in 1914 during World War l, the crash in 1929, the recession of 1937, Black Monday in 1987, the Dotcom bubble in 2000, the Great Financial Crisis in 2008, COVID, and the Liberation Day crash from President Trump’s tariffs in April of this year to name a quite a few.

And through it all the market has recovered and will continue to do so. Ultimately, the moral of the story is to invest in high quality companies that will likely go up over time. Markets correct & crash and will continue to do so. Instead of panicking, see this as an opportunity to buy instead of an obstacle.

Buy quality stocks on sale!

Like & subscribe if you’re active duty, a veteran, or just love investing.