Why You Should Own REITs For Passive Income

"Collect Boring Passive Income From Real Estate The Easy Way"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

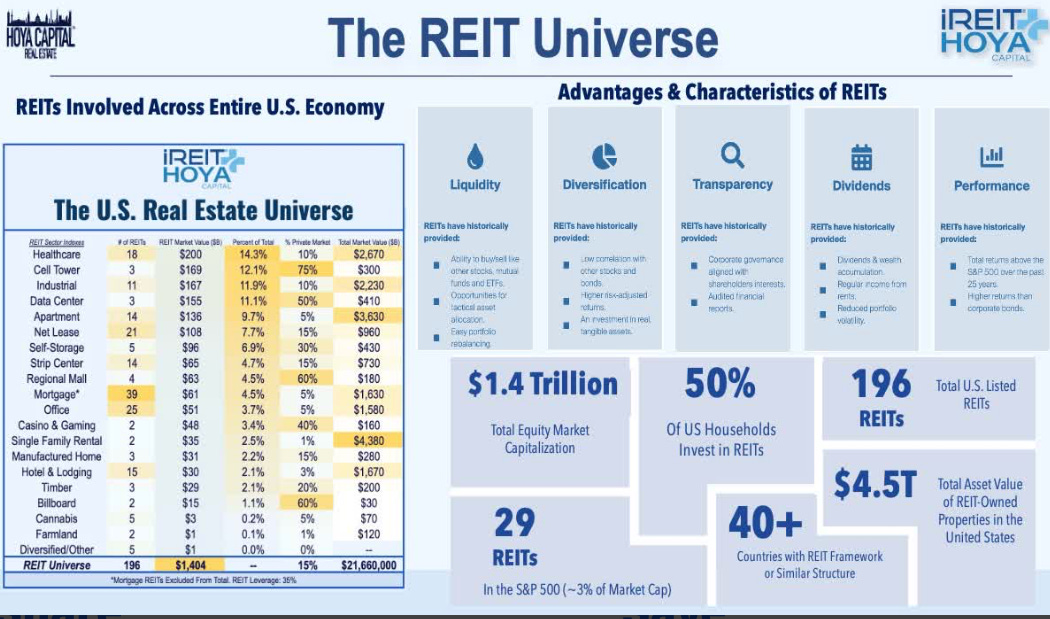

Here’s a snapshot of the REIT market from my investment group iREIT+Hoya Capital. Check us out over on Seeking Alpha if you’re someone looking to build passive income & wealth. There’s a Black Friday sale 20% off right now!

Many people overlook REITs as investments because they’re boring. But as a long-term investor looking to create passive income & build your wealth, boring is good.

REITs were created by Congress in 1960 to give investors access to real estate. And by law they’re required to pay out 90% of their taxable income in dividends.

People use REITs every day. That office building where you work could be owned by a REIT like Kilroy Realty Corp (KRC).

That shopping center where you buy groceries could be owned by a REIT like Dividend King Federal Realty Trust (FRT).

That hospital or medical building could be owned by REITs like Medical Properties Trust (MPW) or Omega Healthcare Investors (OHI) .

That apartment building you live in could be owned by Mid-America Apartment Communities (MAA). That casino & hotel you like to vacation to in Las Vegas is likely owned by VICI Properties (VICI).

Companies like Amazon (AMZN), Starbucks (SBUX), & Walmart (WMT) rarely own their buildings and real estate, they rent them.

This how REITs make money, by collecting rent just like you pay to your landlord or apartment complex.

You order online from Amazon?

A cell tower owned by a REIT like American Tower (AMT) gave you cell service access.

A data center REIT like Digital Realty Trust (DLR) owns the data centers that processed the data & transaction.

The industrial warehouse owned by a REIT like Prologis (PLD) that Amazon (AMZN) pays rent to receive the order to ship it.

This is how you have to start thinking if you want to be a successful investor.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha for 20% off for Black Friday. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

For educational purposes only. I am not a financial professional. Do your own due diligence.