How To Position Yourself To Be A Successful, Long-Term Dividend Investor

Being A Successful Investor Requires Mindset, Discipline, & Strategy

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

On my investment journey, I’ve made plenty of mistakes. Like anything worthwhile, those mistakes ultimately made me a better investor.

When I retired from the military after 21 years of service, I wasn’t entirely sure what came next.

What I did know was what I didn’t want:

Retire… go back to a full-time job… retire again… and barely have time left to enjoy life.

That realization is what pushed me—years before retirement—toward dividend investing. Time is our most important asset. Money you can get back, time is lost forever.

While some investors prefer growth-only strategies, the idea of collecting passive income while my money worked for me was always appealing. Getting paid regardless of what the market is doing brings a level of peace and flexibility that’s hard to replicate.

That said, investing solely for income has drawbacks. And for investors getting started with dividend investing in 2026, I believe there’s a better way to approach it—one that balances income, growth, and long-term wealth creation.

This article lays out exactly how I’d do it today.

Why Dividends Still Matter in 2026 and Beyond 🚀

In 2026 and beyond, I believe dividends will become increasingly important—and more widely accepted.

One reason is simple: the era of near-zero interest rates is likely behind us.

We may be entering a more “normal” environment—higher rates, higher inflation, and higher everyday costs. That’s something Americans will likely have to get used to.

The days of one job comfortably covering all expenses are fading fast. Food, healthcare, insurance, and housing costs continue to rise over time. As a result, the need for additional income streams is becoming more obvious.

Dividends are just one of many ways to generate that extra income—but they’re a powerful one. History.

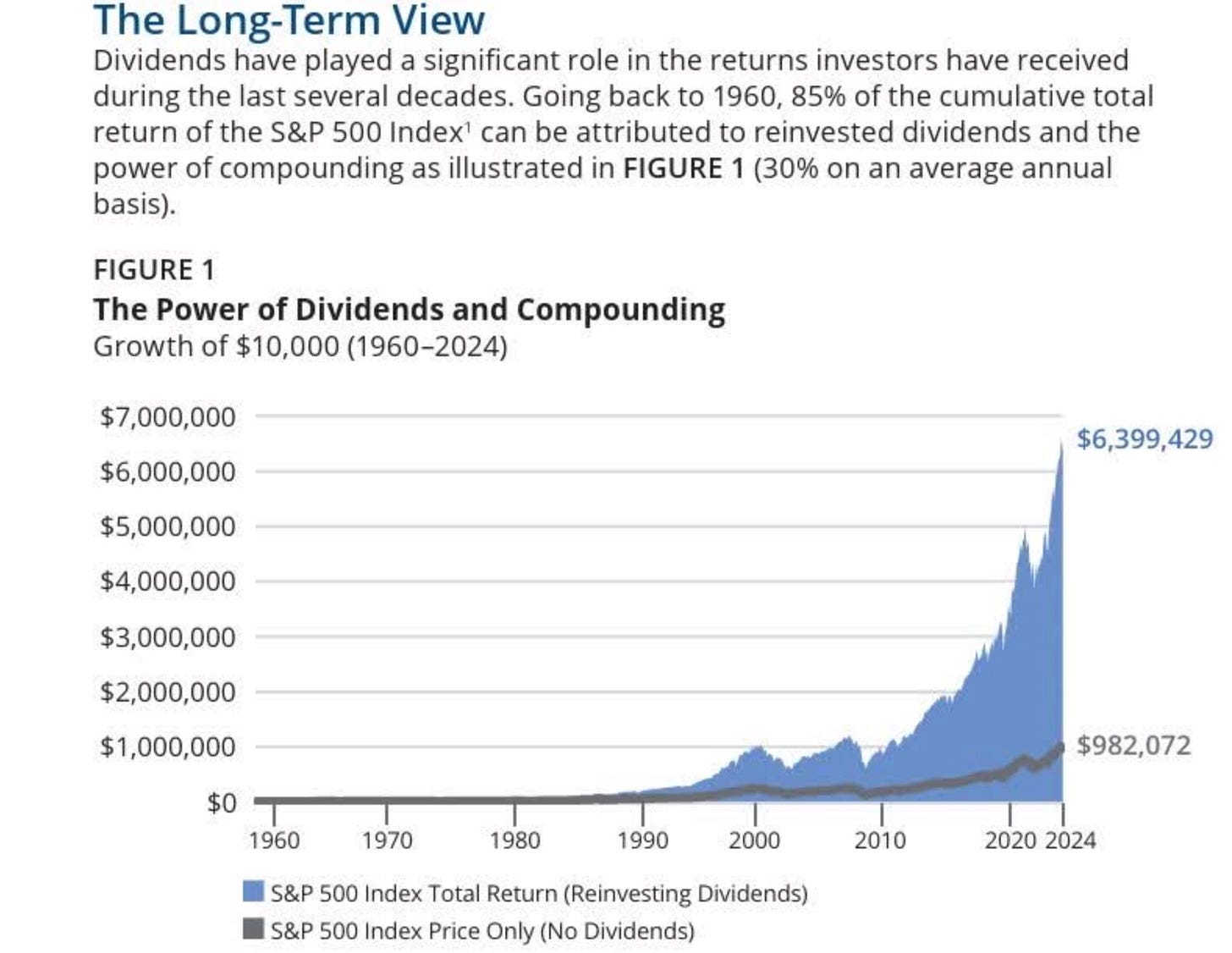

From 1960 through 2024, the S&P 500 (SP500) without dividends grew $10,000 into roughly $982,000.

With dividends reinvested, that same $10,000 grew to approximately $6.4 million—more than 5x higher.

And looking forward, dividends could matter even more.

Why?

Costs will continue to rise over time

Investors today have access to higher-yielding investments that simply didn’t exist decades ago

In 1960:

ETFs didn’t exist (1st in 1993: SPDR S&P 500 ETF (SPY)

REITs were just beginning

BDCs wouldn’t appear until 1980

Covered-call ETFs weren’t even an idea

Today, investors can blend traditional ETFs, REITs, BDCs, and option-based funds to build reliable income streams that were impossible in prior generations.

With that backdrop, here’s how I’d structure a dividend portfolio today.

Letting Go of the Anchor ⚓

During my time in the U.S. Navy, “letting go of the anchor” meant dropping anchor to hold the ship steady when we couldn’t moor in port.

That concept translates perfectly to investing.

If I were starting over, the first thing I’d do is choose a portfolio anchor—and for me, that anchor would be a traditional ETF.

This is a mistake I made early on.

I used to scoff at ETFs, believing individual stocks would always outperform. I thought ETFs diluted returns and that owning great companies directly was the superior approach.

Reality taught me otherwise.

Over the past year, well-known individual stocks like Costco (COST), PepsiCo (PEP), and Coca-Cola (KO) have underperformed broad ETFs such as the S&P 500 and even dividend-focused ETFs that many investors consider “boring.”

Quality doesn’t guarantee outperformance—especially over shorter periods.

My ETF Anchor Criteria 📋

Personally, I’d look for an ETF capable of delivering:

6%–10% long-term total returns

Reliable income

Broad diversification

Reasonable expenses

Examples I’d consider as anchors:

Dividend growth ETFs

Dividend value ETFs

High-quality dividend income ETFs

Some offer higher yields, others better growth, but their job is the same:

Provide stability, consistency, and a solid foundation for the portfolio.

Think: Capital Group Dividend Value ETF (CGDV), Vanguard Dividend Appreciation Index Fund ETF Shares (VIG), Fidelity High Dividend ETF (FDVV), Schwab U.S. Dividend Equity ETF (SCHD), & iShares Core Dividend Growth ETF (DGRO)

These anchors aren’t meant to be exciting—they’re meant to keep the ship steady.

Adding Dividend Compounders: Wealth Growth💰

Once the anchors are in place, I’d layer in dividend compounders.

These are high-quality businesses with:

Durable competitive advantages

Strong balance sheets

Consistent cash flow growth

Above-average dividend growth

Companies like Visa (V), Mastercard (MA), Waste Management (WM), and T-Mobile (TMUS) fall into this category.

These stocks often:

Trade at premium valuations

Offer lower starting yields

Deliver double-digit dividend growth

That combination—rising earnings + rising dividends + time—can lead to meaningful long-term outperformance.

Over the past decade, many of these businesses significantly outpaced the broader market on a total-return basis. While past performance doesn’t guarantee future results, quality compounders have historically rewarded patient investors.

Their role in the portfolio is simple: Grow wealth and grow income over time.

Using Higher Yields for Income Stability (Without Chasing Yield) ↗️

This is where I made one of my biggest mistakes early on: chasing yield.

High yields can be useful—but only when used correctly.

If you’re retired or nearing retirement, allocating more capital to yields above 5% can make sense. But investors should manage expectations. These investments often:

Grow slowly

Deliver low single-digit total returns

Prioritize income over appreciation

I think of these holdings as dividend stabilizers.

They’re designed to:

Provide dependable cash flow

Reduce portfolio volatility

Support income needs

This is where REITs (XLRE), BDCs (BIZD), telecoms, and select covered-call ETFs can play a role.

For example, telecom giant Verizon (VZ) has been a steady payer for me, you may not get much price appreciation, but that dividend is consistent and well-covered by cash flows.

Some notable REITs: Realty Income (O), Agree Realty (ADC), Getty Realty (GTY), VICI Properties (VICI), Starwood Properties (STWD), & EPR Properties (EPR).

And covered-call ETFs to consider: Goldman Sachs S&P 500 Premium Income ETF (GPIX), Goldman Sachs Nasdaq-100 Premium Income ETF (GPIQ), NEOS S&P 500 High Income ETF (SPYI), TappAlpha SPY Growth & Daily Income ETF (TSPY), & NEOS NASDAQ-100 High Income ETF (QQQI).

What I Look For 👀

Strong fundamentals

Sustainable payouts

Reasonable leverage

Quality management

Some may never grow their dividends meaningfully—but reliability matters more here than growth.

Monthly payers can also be attractive, as more frequent income can accelerate compounding and help smooth cash flow.

Covered-call ETFs can fit here as well, provided investors:

Watch expense ratios

Monitor NAV erosion

Focus on long-term sustainability

High yield alone is not a strategy. While collecting massive income looks good on paper, this is highly unlikely to be sustainable. Quality always comes first.

Investor Takeaway ✅

If there’s one lesson I’ve learned over the years, it’s this:

Strategy matters more than individual stock selection.

Even the best businesses can underperform. Even “safe” investments can disappoint. That’s why every holding in your portfolio should have a job.

ETFs for stability

Compounders for growth

Higher yields for income

Avoid chasing yield. Manage expectations. Stay disciplined.

Every investment carries risk, and nothing is guaranteed. But using a thoughtful, balanced approach like this is what helped me improve my results—and it’s exactly how I’d build a dividend portfolio in 2026.

What stocks are on your list?

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha.

Here’s How: Click the Seeking Alpha link here. Click investing group, subscribe now, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.